Let’s Get Into the Green

Extraordinary Days Events

Extraordinary Days Events

I can say confidently that our budget has been the biggest consideration in every one of my and Roo’s wedding planning decisions. I wouldn’t say that we would have a totally different wedding if money was no object, but I would definitely invite more than 90 guests and splurge on a few things we’ve decided to go without. It turns out our $15,000 budget is a ridiculously low number for an urban city wedding, but it’s a huge amount of cash to us.

(I want to preface this post by saying I am not the poster child for building a wedding budget. I think we’re doing everything “wrong” according to conventional wisdom. But Mr. Rooster and I are both really great with money, so our approach to budgeting is definitely a little less organized than most. But whatever. Here it is.)

Where’s the Money Coming From?

The money for the big expenses is coming from an account I created exclusively for wedding costs. As soon as it looked like Roo and I might be heading down the aisle, I decided to start a savings account and put money into it whenever I could. My pre-engagement account eventually became our joint wedding account after Roo popped the question. Without a doubt, starting early was the best decision I could have made. My little nest egg allowed us to get started right away and make deposits to a venue and photographer as soon as we found them.

Celebrate Today on Etsy

Celebrate Today on Etsy

Here are all the sources that add up to make up our wedding fund:

- My pre-engagement wedding savings. I was saving exclusively for wedding costs for about a year before our engagement, so we had a good little chunk of money to start from.

- Some help from our parents. Our folks on both sides have been very generous and contributed lump sums to help with our wedding expenses. We weren’t counting on their help (and are still paying for 75% of the wedding ourselves), but their contributions have given us some breathing room.

- Regular deposits from each paycheck. Roo and I each have money going straight from our paychecks into the wedding account at fixed amounts twice a month.

- Any “extra” income. Since we’ve been engaged, whenever one of us comes into some cash outside of our normal personal budget, we make a deposit for the wedding. This includes any freelance writing income, birthday money, tax return refunds and work bonuses.

To other brides or soon-to-be brides, I definitely recommend having one account set aside exclusively for wedding expenses. This way you get a really great picture of your budget, and you can see exactly how much you have and how much you need at every stage of wedding planning.

How Are We Splitting the Budget?

This is where I’m supposed to recommend one of those downloadable wedding spreadsheets that takes your budget total and calculates all your line items for you. They’re great, I know. But I just can’t do it. I don’t know if you want to call it “resourceful” or “being stubborn,” but I wasn’t about to let a spreadsheet tell me what I should spend on a venue versus a dress.

Our plan for the wedding was to splurge on a few top priorities, and leave out others, so a pre-balanced spreadsheet doesn’t help much. We planned to spend more than the suggested 10 percent on a photographer, but way less than 10 percent on attire.

That said, I would still recommend that non-budgeting brides like me still at least give the wedding spreadsheet thing a try. In a kind-of depressing way, the spreadsheet helped me figure out that we couldn’t do everything we wanted on our budget and showed me where we would need to cut back. When I keyed in the $3000 we wanted to spend on a great photographer, it left very little for everything else. Like, impossibly little. I knew to avoid going into debt there would be no room for hiring a florist. Since I would rather have great photos than great flowers, we cut the stems from the wedding (opting instead to DIY whatever limited florals we will have) to give everything else a little padding.

What’s Not in the Budget?

I kind of feel like I’m lying when I say our wedding budget is $15,000, because our budget doesn’t include two big expenses that some other budgets include: The rings and the honeymoon. We wanted to do the math just for the party and keep jewelry and travel expenses separate.

And another thing: Our $15,000 isn’t really $15,000. There are plenty of small expenses I’m not formally recording. Over the course of planning, whenever a small wedding-related expense comes up that I can pay for out of my normal spending money, I just spend the cash and don’t keep track. For example, I didn’t budget any of the “big” money for invitations or stationery, and instead just used cash in my personal checking account to order envelopes and have my Save-the-Date design printed onto cards. Same goes for the groomsmen’s ties; we just ordered a sample for Roo and he loves it, so he’ll buy his men their ties out of his normal paycheck and not our set-aside wedding money.

Is this the best idea? Probably not. But it’s been the best for us so far. I’ll try to save all my receipts so at the end of wedding planning, I can add it up and discover our “real” wedding budget. That will probably be fun for all of you and eye-opening for me.

Keeping Track of The Big Expenses

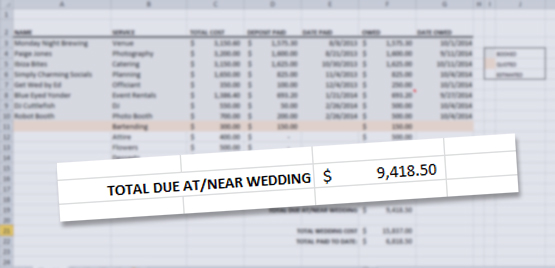

I abandoned the idea of using wedding budget worksheets or keeping a line-item budget for little expenses, but I still need to keep track of what’s been paid to our big-money vendors and, more importantly, what we owe. So I started a “booked budget” spreadsheet. It helps me figure out how close we are to saving enough money in our account for the wedding.

It’s really straightforward. Whenever we book a vendor, I add them to the list and make note of our deposit and what’s due in full later on. The spreadsheet adds it up and gives me a big round number of what’s due near the wedding so I know exactly how much we need to save to meet that goal.

We just got quotes for the last of our vendors last week (the bartenders), so I decided to run the numbers again. Guess what? We’re in the black! If we don’t save a single extra dime from now until September, we’re on track to be able to pay the remaining costs to all our vendors from the cash in our dedicated account.

Every cent from here on out goes towards our dream honeymoon to London. Let’s see if we can make this happen! Any advice for squeezing some extra cash out of the budget?

Hi! I'm Taryn, a writer, designer and soon-to-be-bride from Atlanta, Georgia. Sit a spell with me and catch up as I plan the wedding of my beer-loving, confetti-throwing dreams to the wonderful Mr. Williford.

Hi! I'm Taryn, a writer, designer and soon-to-be-bride from Atlanta, Georgia. Sit a spell with me and catch up as I plan the wedding of my beer-loving, confetti-throwing dreams to the wonderful Mr. Williford.